are st jude raffle tickets tax deductible

Jude Dream Home Giveaway house. The IRS has adopted the position that the 100 ticket price is not deductible as a charitable donation for Federal income tax purposes.

Saint Agnes School Posts Facebook

The IRS does not allow raffle tickets to be a tax-deductible contribution.

. Jude Birthday Fundraiser Instead of Gifts. By chance at a single occasion among a single pool or group of persons who have paid or promised a thing of value for a ticket that represents a chance to win a. Jude may deliver the prize to the winner.

Fist of all most charities will simply tell you. The house is divided into two separate volumes. All of the proceeds go directly to St.

In a similar fashion when you pay for a ticket at a charity dinner. The drawing will be held on June 20 2009. Maximum amount of deductible approved charitable donations 700000 x 35 Deductible approved charitable donations under Personal Assessment 245000- 50000 195000 How To Check If A Charity Or Church Is A Registered Deductible Gift Recipient This is easy.

Verified In general it qualifies for the child and dependent care credit but. The IRS does not allow raffle tickets to be a tax-deductible contribution. Is St Judes tax deductible.

The Charitable Raffle Enabling Act effective January 1 1990 permits qualified organizations to hold up to two raffles per calendar year with certain specified restrictions. Jude Childrens Research Hospital is exempt from federal income taxes under Section 501C 3 of the Internal Revenue Code. The purchase of a raffle ticket is not considered a charitable donation.

The house is divided into two separate volumes. You can deduct the price of your ticket for taxes but you must first subtract the value of your dinnerdrinks. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status.

The IRS does not allow raffle tickets to be a tax-deductible contribution. You will have a chance to. This might sound nonsensical on the surface.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Jude Childrens Research Hospital. There is the chance of winning a prize.

Are raffle tickets tax-deductible. However the answer to why raffle tickets are not tax-deductible is quite simple. The IRS has ruled that a payment for a raffle ticket is a tax-deductible charitable contribution only to the extent the amount of the payment exceeds the price of.

For specific guidance see this article from the Australian Taxation Office. Winners are encouraged to consult a tax professional. How much of the proceeds actually go to St.

Winner must be present. Something additional to consider is that while you cant take a tax deduction from buying a charity raffle ticket. This is because the purchase of raffle tickets is not a donation ie.

The IRS considers a raffle ticket to be a contribution from which you benefit. If the amount of money paid or a ticket is equal to or less than the fair market value of. Although raffles tickets are a form of donation they are not tax deductible.

If you receive a benefit from making a donation you can only deduct the amount of your donation that is greater. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Therefore your gift is tax-deductible to the full extent provided by law.

The IRS does not allow raffle tickets to be a tax-deductible contribution. The taxes on the home. The reasoning is that only the amount actually going to charity not feeding you should be tax-deductible.

The IRS requires that taxes on prizes valued greater than 5000 must be paid upon acceptance and before St. The IRS has ruled that a payment for a raffle ticket is a tax-deductible charitable contribution only to the extent the amount of the payment exceeds the price of. Why are raffle tickets not tax-deductible.

Jude and its mission.

Dodgeball For The Arts Enter To Win A 2 Night Stay Plus 100 In Las Vegas Nv Kickball Party Kickball Tournament Dodgeball

St Jude Payne Family Homes Team Up For Annual Dream Home Giveaway News Midriversnewsmagazine Com

Dream Home Faq St Jude Children S Research Hospital

Image Result For Nonprofit Donation Letter For Tax Receipt Donation Thank You Letter Donation Letter Template Donation Letter

Father S Day Ultimate Bourbon Giveaway To See All Proceeds Go To Charity The Whiskey Wash

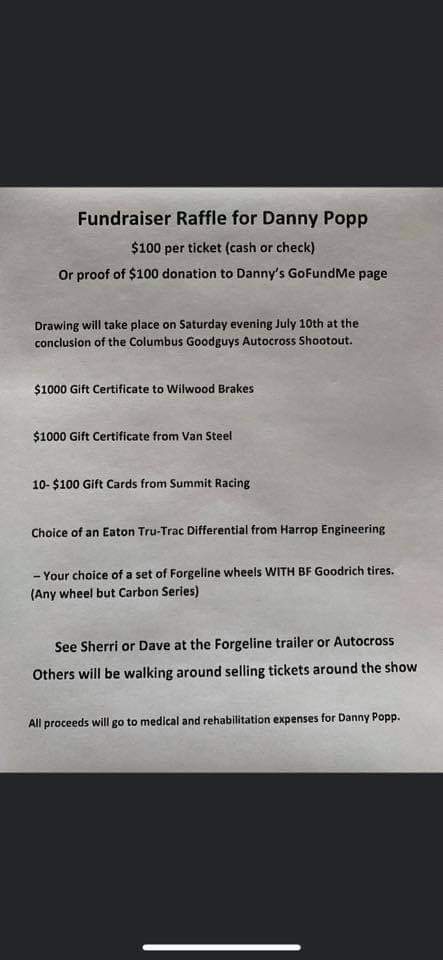

Gofundme For Danny Popp Aka Raftracer Corvetteforum Chevrolet Corvette Forum Discussion

Why Do Grocery Stores Ask For Donations Tax Breaks

Mary Elizabeth Memorial Golf Tournament Silent Auction Home Facebook

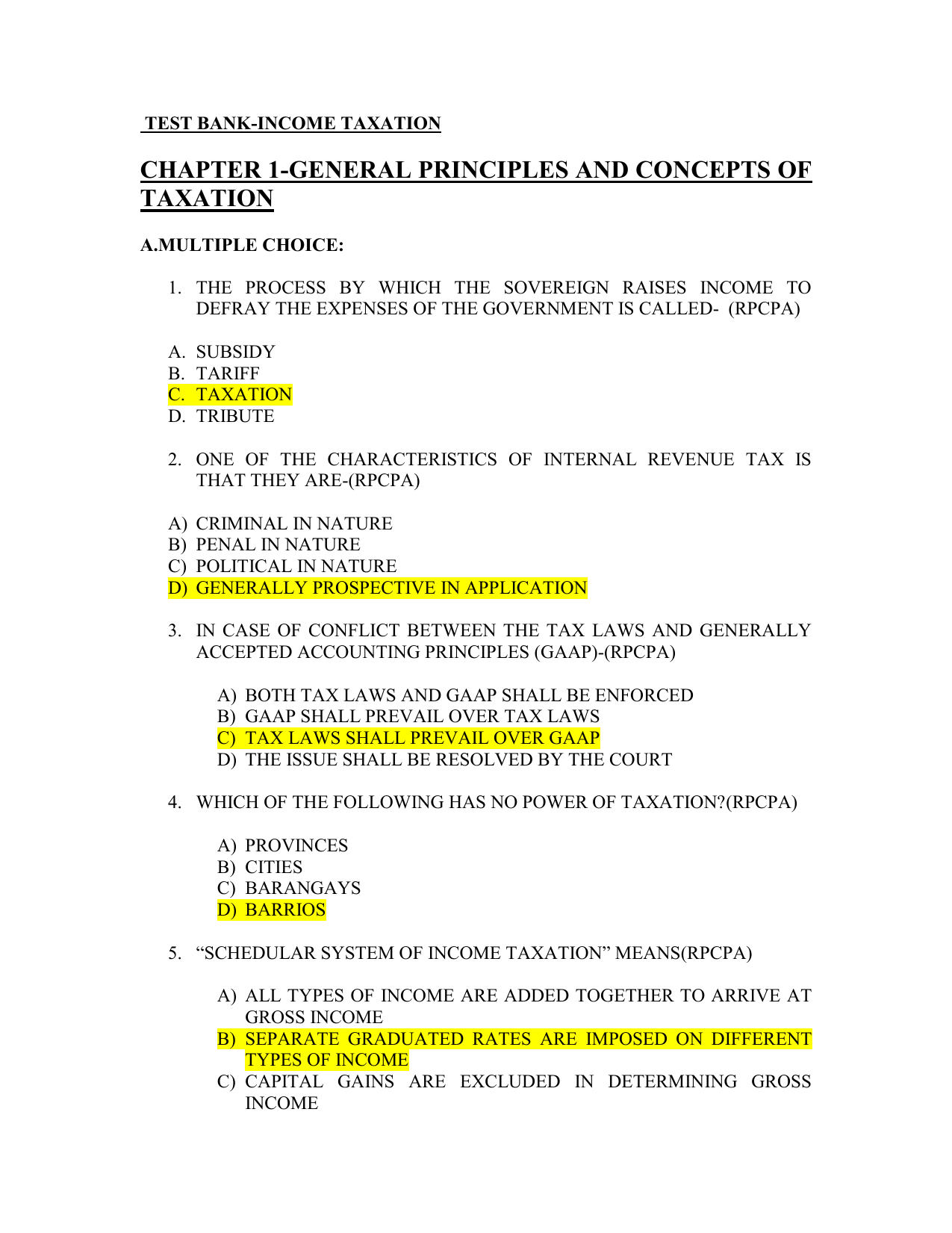

Student Copy Test Bank Income Taxation

St Jude Dream Home Giveaway Faq Everything You Need To Know Fox 8 Cleveland Wjw

A 550 000 Home Raffle Ends With An Unfortunate Fortune Wfaa Com

A 550 000 Home Raffle Ends With An Unfortunate Fortune Wfaa Com

Dancers Making Waves Home Facebook

Donation Letter Donation Letter Donation Letter Template Donation Letter Samples

A 550 000 Home Raffle Ends With An Unfortunate Fortune Ktvb Com

Letter Requesting Donations For Silent Auction Download This Silent Auction Donation Reques Donation Letter Donation Letter Template Donation Request Letters